Understanding Security Sensitivity to Good and Bad Times Through Mixture Models

January 24, 2024

•

2 min read

We explore how to leverage Gaussian Mixture Models (GMM) to model regime dependent betas

While investors have often suspected that a security’s price sensitivity to the overall market varies across time, and can change dramatically during periods of market turmoil, it’s not entirely clear how to measure this phenomenon.

One approach taken is to divide up our historical sample of security prices, and subjectively judge which periods we believe represent the regimes of interest (e.g. periods of low vs high market volatility, periods of market drawdowns, etc).

While this approach can be useful, its main drawback is how it relies on our subjective assessments of what represented historically a “good” or “bad” period for the market.

In this article, we’ll instead turn to an alternative approach that relies on statistically modelling the processes underlying the security in question (and the market as a whole) as Gaussian mixtures.

Gaussian Mixture Models

The Gaussian in the name refers to the academic name applied to the so-called Bell-curve, or “Normal,” distribution we’re all familiar with.

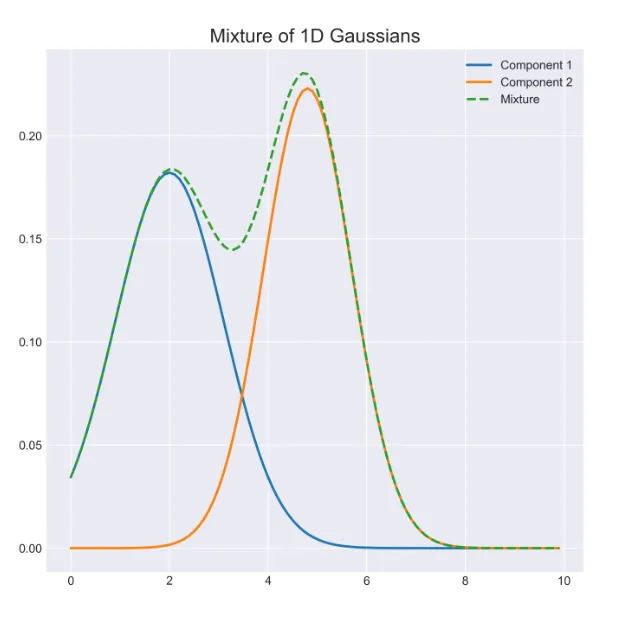

A Gaussian mixture is therefore a mixture of Bell-curve distributions.

A mixture of two Gaussian distributions.

It turns out that mixing Bell-curve distributions has the desirable property that it can well represent the distribution of a security (or the market’s) price returns, that aren’t themselves actually Normally distributed.

Moreover, using such a mixture can help us identify when a security’s return was generated during either a “good” or “bad” regime.1

Essentially we want to use the Gaussian mixture model (herein GMM) to discover the security’s return distributions for both the “good” and “bad” states of the market.

We then want to determine the sensitivity of the security’s price returns to the market as a whole during these “good” and “bad” states, in comparing them.

This sensitivity is usually measured as Beta, and we will maintain that convention here as well. Therefore, the GMM model facilitates comparison of the security’s measured Beta during the “good” and “bad” states automatically.

Finally, we can use the GMM model to determine which state the security’s price was in, historically.

In this sense, the GMM can be considered a “regime model.”

Example Setup – GMM on Barrick Gold

For this particular example, we will use the market’s current, and lagged returns, as the inputs that determine the regime state at any time ‘t’.

- Our proxy for the market will be the SPDR S&P500 ETF (ticker: SPY).

- The target security for the model is chosen as Barrick Gold (ticker: GOLD).

Why Barrick Gold?

- Barrick Gold is chosen as an example here, given the oft-cited expectation that its Beta is roughly zero.

- The story goes, that Barrick Gold, being a gold mining company, shouldn’t in principle be affected by what happens in the equity markets.

- We will show that during periods of market crisis, the Beta on Barrick Gold stock can change dramatically.

Navigating Bias in AI with Open-Source Toolkits

Navigating Bias in AI with Open-Source Toolkits

AltaML Secures Spot on AIFinTech100 for Consecutive Year

AltaML Secures Spot on AIFinTech100 for Consecutive Year

Jurisage and CiteRight Finalize Merger, Become Jurisage Group Inc.

Jurisage and CiteRight Finalize Merger, Become Jurisage Group Inc.