-

What We Do

-

AI NavigatorGain clear direction and momentum as your chart your organization’s AI path.

-

AI FoundationsEstablish the essential skills, systems, and mindset to support sustainable AI adoption.

-

Agentic AI LabExplore, prototype, and refine agent-driven solutions to accelerate real-world impact.

-

GovLabAdvance government innovation with practice AI solutions tailored to unique public sector needs.

-

-

Featured

The AI Agent Advantage: Understanding Your Digital Workforce

The AI Agent Advantage: Understanding Your Digital Workforce

-

Some Industries We Support

-

Energy and ResourcesDrive innovation and promote sustainability while gaining a competitive edge.

-

Financial ServicesBoost efficiency, reduce costs, and streamline processes.

-

Forestry and AgriculturePave the way for a productive, efficient, and greener future.

-

HealthRevolutionize care delivery, improve outcomes, and save lives.

-

ManufacturingStreamline production, eliminate costly downtime, and enhance quality control.

-

-

Featured

Building Canadian Communities with Homegrown AI

Building Canadian Communities with Homegrown AI

-

Services

-

What We Do

-

AI NavigatorGain clear direction and momentum as your chart your organization’s AI path.

-

AI FoundationsEstablish the essential skills, systems, and mindset to support sustainable AI adoption.

-

Agentic AI LabExplore, prototype, and refine agent-driven solutions to accelerate real-world impact.

-

GovLabAdvance government innovation with practice AI solutions tailored to unique public sector needs.

-

-

-

Industries

-

Some Industries We Support

-

Energy and ResourcesDrive innovation and promote sustainability while gaining a competitive edge.

-

Financial ServicesBoost efficiency, reduce costs, and streamline processes.

-

Forestry and AgriculturePave the way for a productive, efficient, and greener future.

-

HealthRevolutionize care delivery, improve outcomes, and save lives.

-

ManufacturingStreamline production, eliminate costly downtime, and enhance quality control.

-

-

- Insights

-

About

Insights

AI as a Value Creation Engine in Private Equity

The old playbook for private equity (PE), relying on financial engineering and operational tune-ups, is under pressure. In today’s market of higher interest rates, tighter margins, and longer hold periods, those traditional levers aren’t as reliable or scalable as they once were.

Enter artificial intelligence (AI). As AI technology matures, it offers a new, durable way to create value. We’re not talking about a one-off efficiency tool or a passing trend. We’re talking about a fundamental shift that enables faster, smarter, and more scalable value creation across the entire investment lifecycle. From sourcing and screening deals to optimizing operations post-close and preparing assets for exit, AI enhances every step along the way. AI doesn’t rely on adding headcount to improve operations. It creates repeatable, compounding workflows that unlock insights and streamline processes across your portfolio.

Firms that deeply integrate AI into their operations achieve a huge structural advantage, not only changing how they capture value, but also how they create value. Beyond signalling technical sophistication to investors, a firm’s AI-enabled strategy shows its ability to adapt, scale, and drive differentiated outcomes in a more challenging and competitive private market landscape.

Why PE Needs a Fourth Layer

For decades, PE has mastered three key levers to deliver outperformance: financial engineering, multiple expansion, and operational improvement. These strategies worked like a charm, especially when market conditions were favourable. But today, the game has changed. The old playbook is straining under some serious headwinds:

- Higher interest rates have made traditional leverage less effective. Debt was a surefire way to boost returns, but now it comes with a higher price tag. This can reduce the internal rate of return (IRR) potential and increase risk, which is a tough pill to swallow for returns. In fact, between 2021 and 2024, median buyout IRR dropped by nearly 400 basis points.

- Multiple expansion is no longer a given. Entry valuations are staying high, and it’s tougher to find the right time to exit. With public markets resetting, firms can’t simply assure they’ll get a higher multiple when it’s time to sell.

- Operational improvements are still crucial, but they’re harder to scale. Things like organizational restructuring and market refinements require a ton of time, people, and coordination. In fragmented industries, simply integrating new companies can eat up years of a value creation runway.

At the same time, PE firms are sitting on a tidal wave of untapped data. Portfolio companies run on dozens of different systems, from CRMs and ERPs to inventory and HR. All of these systems generate a wealth of information. The problem? That data is rarely put together or analyzed fast enough to drive meaningful change. Traditional operating models, which rely heavily on human-led consulting, struggle to effectively harness all of that data, especially across an extensive portfolio.

Here is where AI emerges as a transformative fourth lever.

AI introduces a powerful concept known as computational leverage, which is the ability to extract insights and execute workflows at a mechanical speed and scale. Unlike human resources, which can only grow so quickly, AI-based tools scale almost effortlessly. Once an AI agent is trained or deployed, it can help with everything from pricing optimization and churn prediction to working capital forecasting, all at the same time and for a minimal cost.

As a recent Bain & Company report put it: “AI offers plenty of ways to streamline or automate back-office functions. But its real power is to dramatically expand the scope of information that the firm brings to bear on investment decisions. These tools can leverage a firm’s scale by making institutional knowledge instantly available to everyone who needs it.”

Critically, AI is different from traditional tools in three ways:

- Non-Linear Returns: As tools take in more data, their outputs get better, which creates compounding value over time.

- Scalability: A successful AI use case, like predictive analytics or a dynamic pricing algorithm, can be rolled out across multiple holding areas with ease.

- Repeatability: Once workflows are digitized and optimized, they become standardized assets. This allows firms to institutionalize value creation that goes beyond the traditional deal teams.

In today’s more competitive market, PE firms can’t afford to wait. AI provides a clear path to driving faster time to impact, unlocking insights from siloed systems and transforming stagnant legacy systems into proactive, high-performing assets. For Limited Partners (LPs), this shift is bigger than technology. It’s about investing in firms that are building real, durable moats around their value creation.

How AI Functions as a Value Creation Lever

Adopting AI is more than running a few isolated experiments; it’s about embedding intelligence into the core of your firm’s operating model. The challenge is that the leap from a good idea to real value isn’t automatic. Many AI projects stall not because the technology fails, but because of common roadblocks: getting people to change how they work, old workflows that are hard to move, or a lack of coordination between teams. For PE firms, especially those doing roll-ups or multiple arbitrage, a failed AI adoption can seriously hurt their deal outcomes.

To avoid this, you have to treat AI deployment as a discipline, not a one-off project. Firms need to intentionally build cross-functional teams, rethink and redesign workflows from the ground up, and make the right investments in data governance. You need more than good technology to succeed; you need a culture that’s ready to adopt it. The best AI tools are meaningless if your employees are worried about job security or refuse to use them. Change needs to happen in the day-to-day decisions, like a dispatcher trusting a new route suggestion, an accounts payable clerk approving a machine-coded invoice, or a sales rep using an AI-generated lead follow-up email. In this sense, AI is less about replacing people and more about optimizing how work gets done. It augments decisions, reduces friction, and helps capture and reuse institutional knowledge across your entire portfolio.

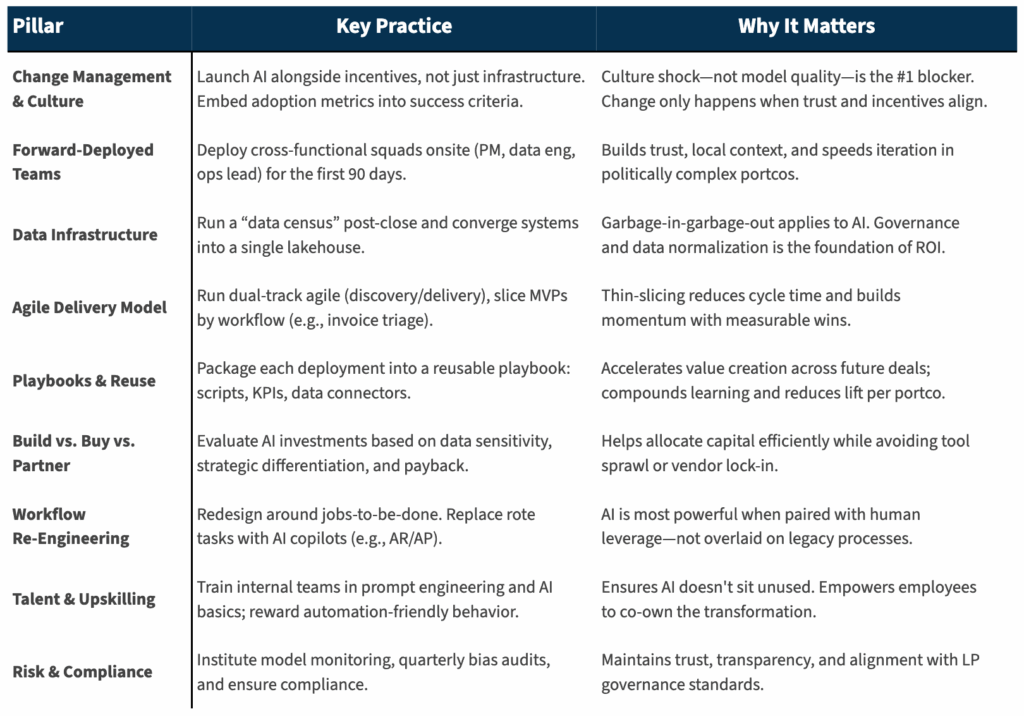

This checklist outlines a practical framework for PE sponsors to operationalize AI in their portfolio companies:

The Economics of the AI Lever

Integrating AI into a PE model is as much about smart economics as it is about operations. While traditional levers like cost-cutting and boosting revenue often hit a wall, needing more capital or people to grow, AI offers a new kind of return that’s much more attractive:

- Upfront Investment: You’ll spend capital upfront on AI tools, training, and integration.

- Low Marginal Costs: After initial deployment, AI agents and workflows can be reused across assets at a minimal additional cost.

- Compounding Returns: With each new deployment, your AI models get better, data gets richer, and you get faster insights for monitoring your portfolio.

- Scalable Intelligence Layer: Improves firm-wide efficiency without constantly needing to add more people.

At its core, AI changes the unit economics of value creation. Instead of hiring a new team of consultants for every deal, firms can build reusable tools that get smarter over time. For example, a churn prediction model trained on one company’s data can be fine-tuned and deployed across other holdings. This speeds up the time to get insights and lowers the cost for each application. The result is a scalable intelligence layer, an operating model that gets more effective and cheaper over time.

The economics of holding periods are also impacted. With traditional tools, it can take 12-24 months to see meaningful operational improvements. AI can accelerate this by surfacing value levers in weeks, not quarters. The result? Reduced time to impact and front-loaded value creation in the early years of ownership, improving your IRR even if your MOIC stays the same. In today’s market, where holding periods are getting longer, this is critical.

AI also has the power to reduce friction regardless of deal size or complexity. In roll-ups or multi-entity strategies, the high cost and time of integration often eat into returns. AI can automate data normalization, system integrations, and performance benchmarking, creating a standardized approach that is both faster and more accurate. Doing this makes smaller or more complex targets economically viable from the integration standpoint, ultimately expanding the universe of potential deals for GPs.

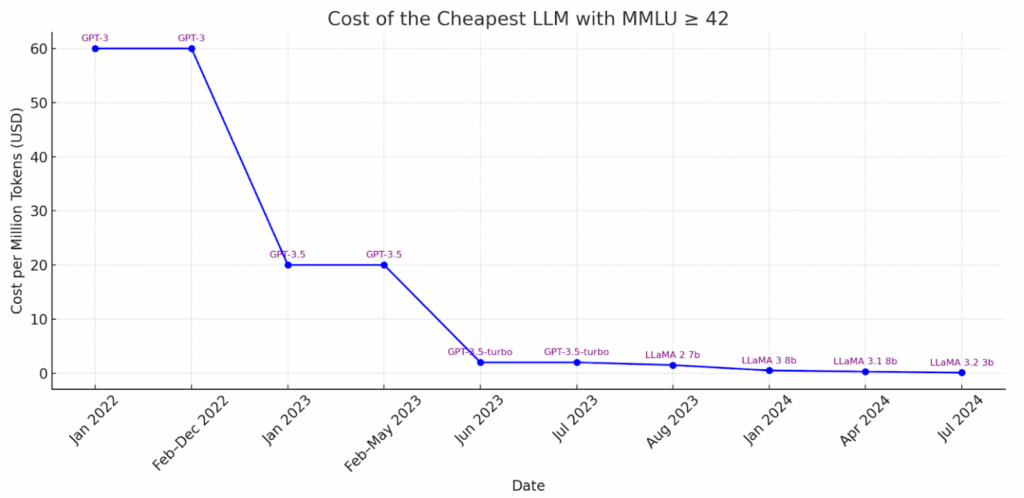

Graph: Cost per million tokens of the cheapest LLMs with strong benchmark performance (MMLU ≥ 42), 2022–2024.

As large language models (LLMs) become more affordable and powerful, AI-led value creation is no longer just for big firms with proprietary platforms. Now, smaller funds, including mid-market GPs, can use off-the-shelf tools and pre-trained models to get in on the action. For LPs, this is a big deal. Firms that bake AI into their playbooks do more than boost operational capacity; they fundamentally change how efficient their capital is without bloating overhead. When execution speeds up and costs drop, more of each LP dollar goes to work, faster and more efficiently than before.

What This Means for LPs

For LPs, the rise of AI reflects an inflection point in how value is created, measured, and scaled. In a market with slower exits and greater operational complexity, firms that consistently generate returns, without bloated cost structures or extended timelines, are the ones LPs find most attractive. AI is what makes this possible.

When AI is embedded into the investment cycle, it compresses the time it takes to execute value creation plans. Onboarding is faster, and insights arrive earlier. Bottlenecks in integration or analytics are solved with software, not additional hires. This improves time to impact and fund-level efficiency, making your dollar more impactful, faster, and without friction.

Importantly, AI introduces consistency into the traditional operating model. In roll-ups or multi-entity strategies, value creation can be uneven. One asset can execute flawlessly, while another lags due to an integration issue, misaligned KPIs, or information silos. AI reduces this volatility by standardizing workflows, spotting anomalies early, and embedding best practices directly into the software.

Just as LPS once distinguished between allocators and true operators, they can now tell the difference between firms that adopt AI as a simple checkbox and those that restructure their operations to create real, measurable value.

Ready to Work on Your AI Strategy?

For firms and investors ready to move beyond theory, AltaML can provide AI diagnostic sprints that identify 3-5 high-impact pilots for each portfolio company. These sprints are designed to uncover specific workflows where AI can unlock measurable value, tailored to each company.

Whether you’re deploying a new fund, transforming an existing portfolio, or anything in between, these diagnostics are the fastest way to turn AI from a buzzword into a bottom-line lever.